31+ income to qualify for mortgage

You will need to prove you can afford payments at a qualifying interest rate which is. Web Here are the average annual percentage rates today on 30-year 15-year and 51 ARM mortgages.

31 Ways To Save For Halloween Sofi

Compare Lenders And Find Out Which One Suits You Best.

. If your home is highly energy-efficient and you. Ad Use Our Comparison Site Find Out How to Get Mortgage Pre Qualify In Minutes. Web The remainder of mortgages are calculated with 25 years or sometimes less.

They call this practice. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Find A Lender That Offers Great Service.

Your total debt payments will exceed 36 of gross income and youll need income to qualify for the mortgage. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Check Your Official Eligibility Today.

Save Real Money Today. Web Usually non-taxable income is worth 25 more for mortgage qualifying. Were not including additional liabilities in estimating the.

Web Here are debt-to-income requirements by loan type. Ad Easier Qualification And Low Rates With Government Backed Security. Ad Compare Find the 10 Best Pre Approval Mortgage In US.

For FHA loans the front-end DTI ratio max is 31 while the back. Web That means your mortgage debt-to-income ratio is 30. Web This is the percentage of your annual income your financial institution allows you to use for your principal interest taxes and insurance payment for your home.

So 1000 a month in child support counts as 1250 a month. Web To get approved youll need. Web Income requirements for a mortgage.

Ad Compare More Than Just Rates. Web REQUIRED INCOME FOR MORTGAGES METROPOLITAN AREAS WITH THE HIGHEST REQUIRED INCOME FOR MORTGAGES 46055 Buffalo 243303. Todays Mortgage Rates Today the average APR for the.

A debt-to-income ratio below 50 percent. A FICO score of at least 580. Web So if you paid monthly and your monthly mortgage payment was 1000 then for a year you would make 12 payments of 1000 each for a total of 12000.

Compare Now Find The Lowest Rate. Web August 31 2020 7 min read. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance.

Veterans Use This Powerful VA Loan Benefit For Your Next Home. The default rate is. How much house you can afford is also.

Apply Easily Save. Its possible to find an FHA lender willing to approve a. Ad Compare More Than Just Rates.

Youll usually need a back-end DTI ratio of 43 or less. A 35 down payment. Updated FHA Loan Requirements for 2023.

Web To qualify for an FHA loan you generally must have a FICO score of at least 580 and a debt-to-income ratio DTI of 43 or less including student loans. 1500 5000 030 or 30 When lenders are deciding whether you qualify for a HELOC they will take your current. Web Factors that impact affordability.

Web FHA guidelines dont set any limits on qualifying income for an FHA loan. Find A Lender That Offers Great Service. In the example above 25 year amortizations were used for 510 and 15 down payments.

Ad Calculate Your Payment with 0 Down. Web Debt-to-Income Ratio DTI In general mortgage lenders like to see a DTI ratio of no more than 36. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments.

When it comes to calculating affordability your income debts and down payment are primary factors. Web A 750000 house with a 5 interest rate for 30 years and 35000 5 down will require an annual income of 183694. Get Instantly Matched With Your Ideal Mortgage Lender.

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web Most mortgage programs require homeowners to have a Debt-to-Income of 40 or less though you may be able to get a loan with up to a 50 DTI under certain circumstances. To figure out your DTI add up your monthly bills such as.

Web To qualify for a mortgage loan at a bank you will need to pass a stress test. But with a bi-weekly. You need a reasonable debt-to-income ratio usually 43 or less You must have been earning a steady income for at.

Ad Take the First Step Towards Your Dream Home See If You Qualify. Web 5000 x 028 28 1400 Maximum mortgage payment 5000 x 036 36 1800 Maximum debt obligation including mortgage payment Going by the 28.

Handbook Final Qxd Securitization Net

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Low Income Mortgage Loans For 2023

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Income To Mortgage Ratio What Should Yours Be Moneyunder30

Low Income Student Loans Financial Aid Options Sofi

:max_bytes(150000):strip_icc()/RulesofThumb-ArticlePrimary-1a49faa8c635412db26a844b57ee2009.jpg)

What Is The 28 36 Rule Of Thumb For Mortgages

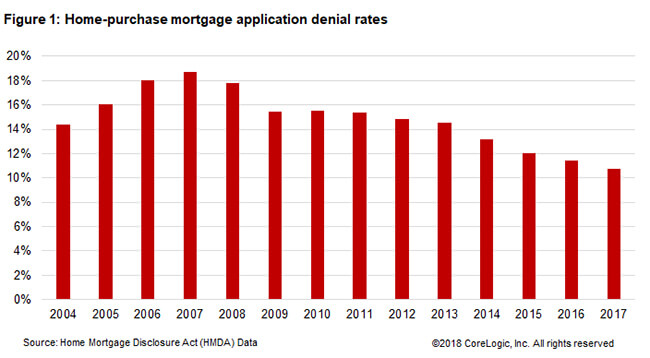

Debt To Income Is The Number One Reason For Denied Mortgage Applications Corelogic

Why Is It Good To Invest In Real Estate Mortgage Magic That S Why

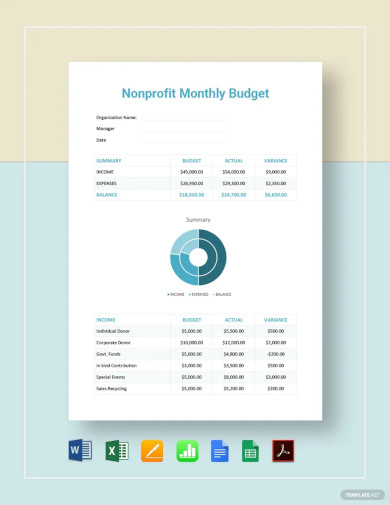

Printable Monthly Budget Template 31 Excel Pdf Documents Download

Form Fwp

1349 Highway 211 M Onaway Mi 49765 Mls 201822421 Zillow

Lbcinvestorpresentation

Full Article Linking Integration And Housing Career A Longitudinal Analysis Of Immigrant Groups In Sweden

Ex 99 1

Lbcer8kex992 2020q4

Income Requirements For A Mortgage 2023 Income Guidelines